A session on claims at the Canadian Reinsurance Conference held in Toronto earlier this year was a neat reminder of the technology gap between underwriting and claims. Increasingly underwriting is underpinned by technology. E-apps and underwriting engines combine a speedy, efficient process with the generation of valuable management information. Claims, on the other hand, still involve a lot of paper and relatively little support by systems.

David Nicolai of Fineos reported research showing that most carriers do not have integrated solutions that support the whole of the claim process. What systems there are tend to facilitate only part of the process and often have been built in-house. As a result the claims process is unnecessarily complex, consistent decision-making and customer service are difficult to deliver, and the data needed to analyze experience and performance is lacking.

The vision Nicolai offered was of smart claims processing enabled by technology, for example:

- Automated assignment via workflow of cases to assessors based on claim characteristics and assessor authority/experience

- Electronic claim files

- ‘Once and done’ record set-up

- Automated data-driven processing and workflow including case triage, alerts, diarization, reserve calculation, etc

- Monitoring and management of third-party provider activities and relationships

- Centralized document generation and imaging.

Via a claims system’s ‘dashboard’ or ‘workbench’, carriers could analyze detailed management information with a view to developing outcome-based case management strategies that can be adjusted in response to claim trends. For example, ‘high-risk’ claims could be identified earlier.

As we have said before, technology can deliver benefits for claimants too via:

- Higher visibility of claims on company websites

- Online guides to the claim process

- Online notification and submission of claims documentation

- Claim teleinterviews (though the phone is pretty old technology)

- Leveraging the technology inherent in smartphones

- Making use of what ‘digital medicine’ has to offer in terms of quantity, quality and availability of information.

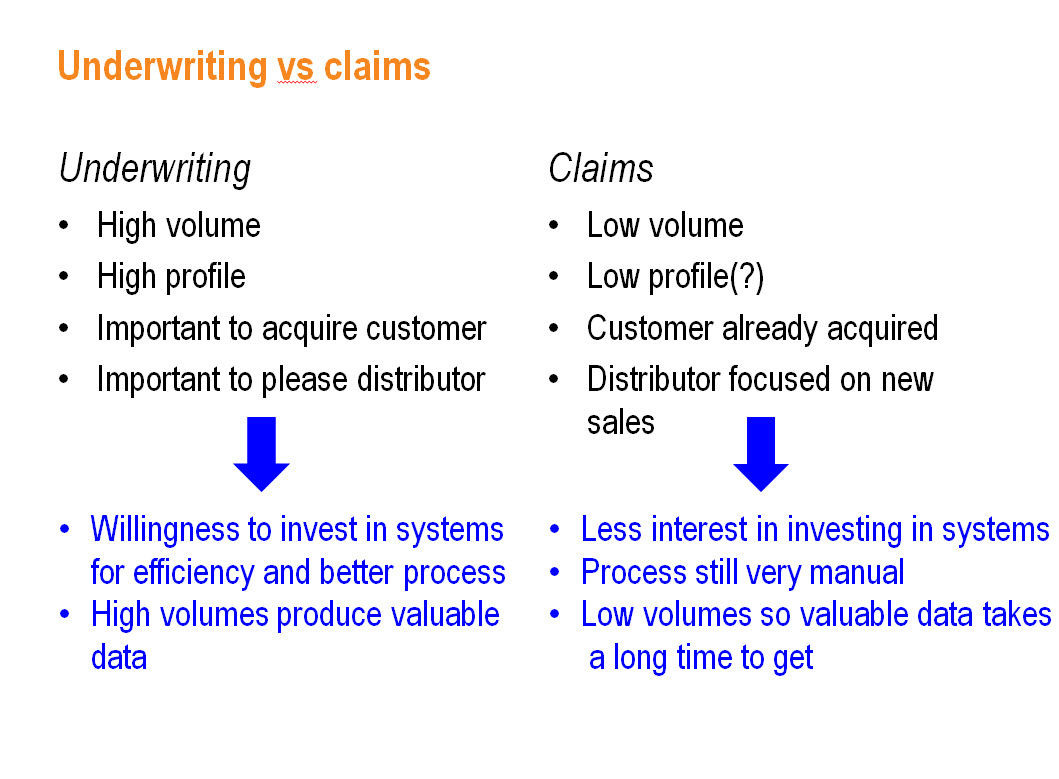

All this ought to be a no-brainer, but insurers tend to see claims as unglamorous, a distinctly poor relation to new business.

New business is positive and sexy. Getting new customers on the books and keeping distributors sweet is important. Combine those factors with the high volumes (compared to claims) and the scope for efficiency savings, and there’s a willingness to invest in technology.

Claims, on the other hand, is a low-volume business, and maybe low-profile too – although get claims wrong and your reputation can be damaged severely and quickly. While one might concede that low volumes are why claims are farther down the priority list when it comes to process investment, there has to come a time when claims get up there with the other front-runners.

For a start, claimants know a clunky, steam-page process when they are in it. Even if you pay the right amount without quibble, the fact that it took a long time and wasn’t the best customer experience does the brand no favors. Then there are benefits like more consistent decision-making, reduced risk of errors, efficiency savings long-term, all that valuable management information and the ability to make service and other improvements in a structured way. All that constitutes competitive advantage over the laggards that shortsightedly fail to invest.

You know it makes sense. Time for Cinderella to go places.